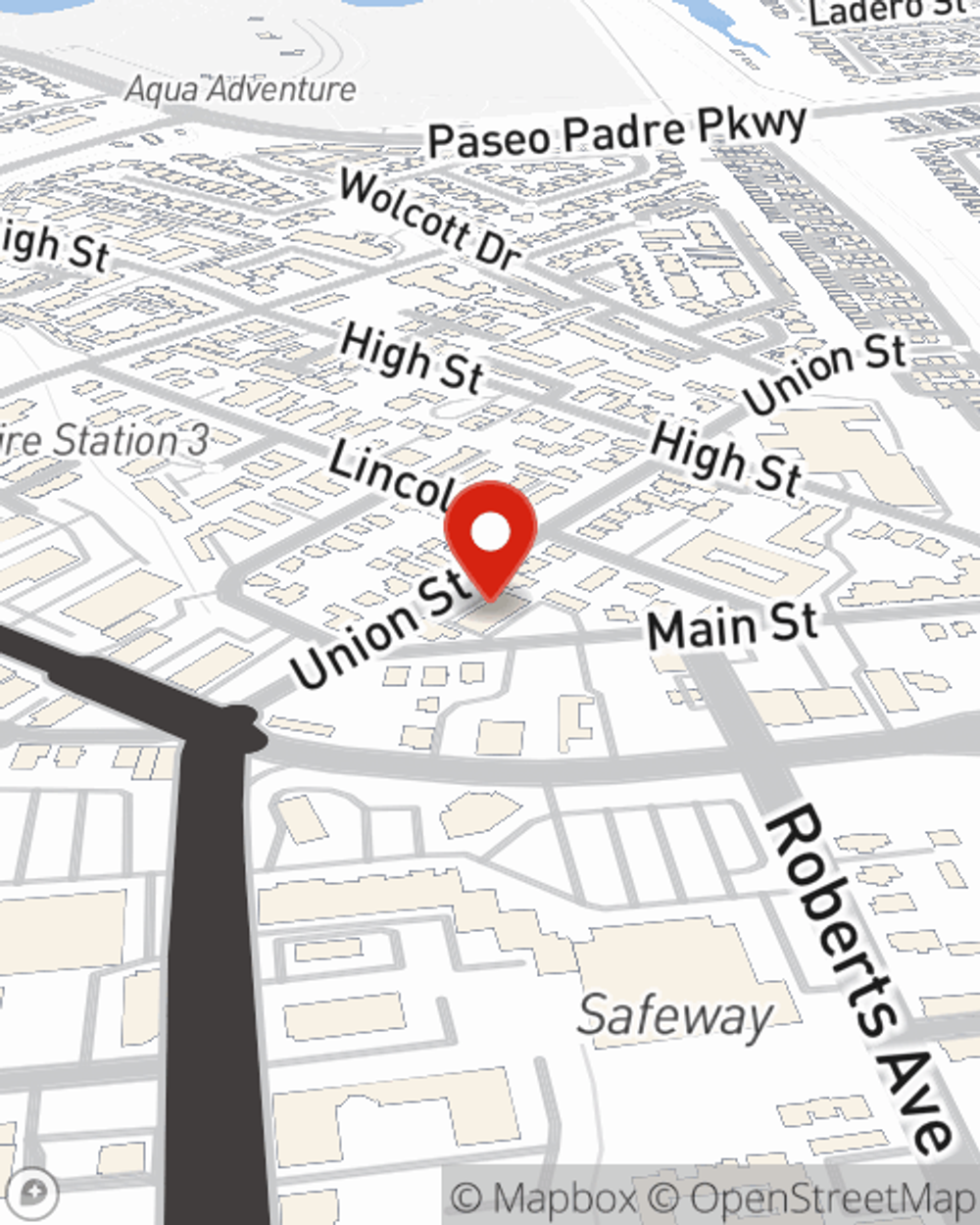

Insurance in and around Fremont

Multiple ways to help keep more of your hard-earned dollars

Cover what's most important

Would you like to create a personalized quote?

- Union City

- San Leandro

- Newark

- San Jose

- Castro Valley

- Pleasanton

- Livermore

- Sunnyvale

100 Years Of Good Neighboring Experience

State Farm understands the need to protect what's important to you and has developed a variety of insurance products with personalized pricing plans to help make life go right. From vehicle and motorcycle insurance that protects your ride, to your boat, motorhome, RV, and off-road ATV, State Farm has competitive prices and easy claims to help you protect them all. Contact Kevin Jopes for a Personalized Price Plan.

Multiple ways to help keep more of your hard-earned dollars

Cover what's most important

Protect Your Family, Autos, Home, And Future

But your car or truck is just one of the many insurance products where State Farm and Kevin Jopes can help. Do you operate a business in the Fremont area or want to be your own boss? Navigating the complicated world of small business insurance? Kevin Jopes can make it easy to find the insurance you need to protect what you’ve worked so hard to achieve. And we also offer a number of liability insurance options to guard the ones you love in the event of an illness or injury.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Gas vs electric golf cart

Gas vs electric golf cart

When buying a golf cart, you’ll need to decide between gas & electric. Consider use, maintenance and cost to help decide which is right for you.

Kevin Jopes

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Gas vs electric golf cart

Gas vs electric golf cart

When buying a golf cart, you’ll need to decide between gas & electric. Consider use, maintenance and cost to help decide which is right for you.